Give your family clarity and peace of mind.

Keep your assets in the family and out of the courts. Need help? A scheduled call with our network attorneys gets you top legal advice. Living trusts start at $279.

Start my living trust

Priced according to your needs

A do-it-yourself living trust that's easy to personalize

- Create a personalized, state-specific living trust

- Our step-by-step guide will take you through the process easily

- Revise as much as you want for 30 days

Get a living trust plus legal advice for 2 weeks after purchase. Legal advice renews monthly at $14.99. Cancel anytime.*

-

2 weeks of legal questions related to your living trust, answered by our network of attorneys

- With advice, get peace of mind with your attorney's review of your living trust once it's done

- Everything included with the Basic Living Trust

The power of 3 documents, all in 1 package. Save 30% by bundling. Plus, legal help for 1 year. Legal advice renews annually at $199. Cancel anytime.**

- Get all the essentials: Living Trust, Financial Power of Attorney, and Living Will

-

1 year of legal questions related to your estate planning, answered by our network of attorneys

- With advice, get peace of mind with your attorney's review of your full estate plan once it's done

Why you need a living trust

Prevent bank issues

Bank accounts can be frozen until their new ownership is settled. Your trust ensures your accounts are available to those you designate with zero interruption.

Avoid probate

Ease the stress and burden off your loved ones. You have the power to prevent them from having to deal with the court system, and incur costly fees. Plus, you can avoid multi-state probate if you own property in another state.

Protect your privacy

Probate court records are public records. This means anyone can have access to your will, and easily obtain a copy. Creating a living trust keeps your personal matters private.

Why choose us

Why choose us

Convenient

Create and complete your living trust from the comfort of your own home.

View Sample

Trusted

Since 2001, we've helped over 3 million customers change the way they protect their families and assets.

Accessible legal advice

Rely on guidance from highly-rated lawyers that you can choose from our vetted network.

Legally binding

Designed and drawn up by our team of experienced attorneys, our living trusts are legally binding in all 50 states.

Here's how it works

-

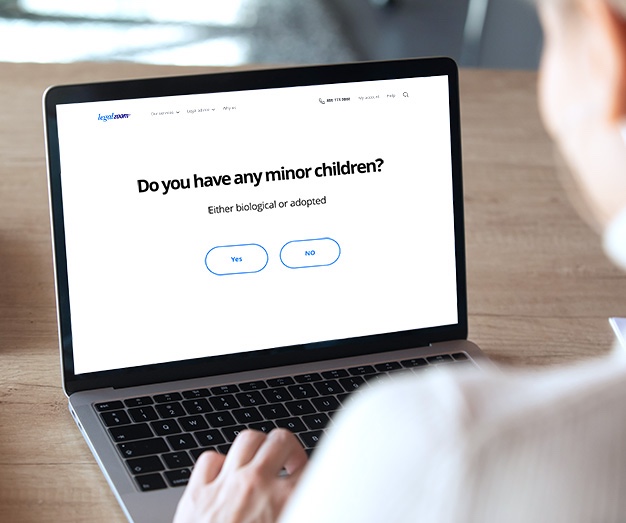

Answer a series of questions

You'll choose someone to settle your affairs, decide what you want to leave to loved ones or charities, and name a guardian for your kids.

-

We'll create your living trust

We'll use your answers to create your living trust, which you can review in your account.

-

Review with attorney, or on your own

Print and complete using our instructions, or have your lawyer do a final review with you over the phone.

-

Fund your living trust

Start funding your trust by transferring the ownership of your assets from yourself to your trust. This means you need to physically change the titles from you, as an individual (or jointly if doing this with a spouse or partner), to the name of your trust. Once it's signed, you transfer ownership of your assets into the trust, but you still remain in complete control of your property.

Get answers to common questions Answers to common questions

It's a legal document that states who you want to manage and distribute your property if you're unable to do so, and who receives it when you pass away. Once signed, you transfer ownership of your assets into the trust and you remain in complete control of your property. The trust property can be managed and distributed without going through the probate court.

Yes. If you have an individual trust, you can transfer property whenever you want. If you have a shared trust, you'll need your co-trustee's consent if you own the property together.

Yes, because you may not have transferred your property into your trust before you pass away. A LegalZoom Living Trust includes a pour over will. It transfers property still in your name alone when you pass away to the trust to be distributed to your beneficiaries. It also lets you name guardians for your minor children.

Probate is the legal process through which the court decides how an estate will be divided. The court will look to your last will to decide how to distribute your property and will follow the will, unless it is successfully contested by your heirs. Generally, if an estate includes real property, a formal probate action is required. However, in many states, if the estate is of minimal value or consists solely of personal property, probate is not required and other legal remedies are available.

Not at all. People of all income levels can set one up to manage their finances in case they become disabled, or to provide for loved ones without going through probate court, which may be required of relatively modest estates.

Yes. A living trust is valid in all 50 states, no matter where it's created and signed. But if you buy property in your new state, you'll want to transfer it into your trust.

It's hard to say, as every person has specific needs. Our customers are often surprised at how easy it is to set up their living trust on their own. If your estate is large or complicated, or you have a child with special needs, you may want to ask an attorney for help.

Attorney Assist (Legal Advantage Plus) is our membership-based service that gives you access to a vetted network of attorneys in all 50 states. You can schedule calls with an attorney to get your questions answered on estate planning, to get your completed documents reviewed, or on other personal legal matters.

Get started today

Personalized to your needs. Designed by attorneys.

Reviews

Reviews

Customer-generated questions and answers

Customer-generated questions and answers

Need help?

Call us at (866) 679-1568

Mon to Fri: 7am - 9pm CST

Weekends: 9am - 6pm CST

Our agents are based in the US

- *Telephone consultations with a participating firm, during normal business hours, of up to one half (1/2) hour each, limited to one consultation for each new legal matter. Excludes business-related matters. Limit one Legal Assist Plan per estate plan. After the 14-day period, your card will automatically be charged $25 and the Legal Assist Plan renews automatically each month at a rate of $25/month. Renewal rate is subject to change. You can cancel online or by calling. Attorney services are fulfilled through Legal Advantage Plus. For full details, see the Legal Plan Contract and Subscription Terms.

- **Telephone consultations with a participating firm, during normal business hours, of up to one half (1/2) hour each, limited to one consultation for each new legal matter. Excludes business-related matters. Limit one Legal Assist Plan per estate plan. Benefits to the Legal Assist Plan continue automatically for $199 per year. You can cancel online or by calling. Attorney services are fulfilled through Legal Advantage Plus. For full details, see the Legal Plan Contract and Subscription Terms.

- Tennessee Residents: Advisory services (also referred to as a legal plan) in TN are provided via a flat fee legal service offering from an independent law firm and are subject to your Limited Scope Representation Agreement with the firm. This portion of the LegalZoom website is an advertisement for legal services. The law firm responsible for this advertisement is LegalZoom Legal Services Ltd. LegalZoom Legal Services Ltd. is authorized and regulated by the Solicitors Regulation Authority of England & Wales. SRA ID 617803. LegalZoom Legal Services Ltd. is a subsidiary of LegalZoom.com, Inc. LegalZoom.com, Inc. does not endorse or recommend any lawyer or law firm who advertises on our site.